Evolving Delivery Options Adversely Impact Demand for Premises-based Business Communications Solutions in Calendar Q2

September 24, 2014

By Frank Stinson

Partner and Senior Analyst, IntelliCom Analytics

The North American Business Communications market declined moderately during the second quarter of 2014 after performing similarly during the first 3 months of the year. Based on the IntelliCom Market Performance Dashboard 2nd Quarter 2014 Report, total manufacturer product revenues across all premise-based voice platforms, end user devices, and traditional and Unified Communications (UC) software applications fell by 8.3 percent compared to the same period a year ago. Cloud-based delivery alternatives have grown to become significant factors in North America as direct offerings from most of the leading providers of premise-based solutions in addition to established competitors operating exclusively on a cloud model. Mitel and ShoreTel (News  - Alert) , in particular, experienced double-digit growth in cloud recurring revenues that offset declines in product revenues from their premise-based portfolios. Cisco Avaya (News

- Alert) , in particular, experienced double-digit growth in cloud recurring revenues that offset declines in product revenues from their premise-based portfolios. Cisco Avaya (News  - Alert), and Mitel also all offer cloud enablement solutions based on their premise-based architectures that a number of third-party service providers utilize as the foundation for their hosted services now also competing for new customers.

- Alert), and Mitel also all offer cloud enablement solutions based on their premise-based architectures that a number of third-party service providers utilize as the foundation for their hosted services now also competing for new customers.

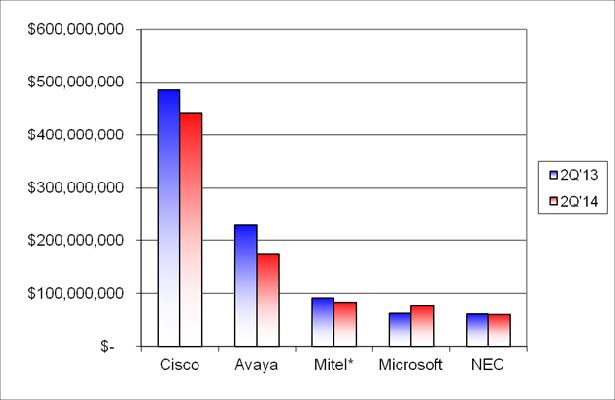

Additionally, multi-year software subscriptions and cross-product enterprise software agreements are beginning to cause an additional deferred revenue effect impacting a number of premise-based providers. Major release upgrades that might have been considered system replacements in past shipment reporting are entitlements of these types of arrangements and can occur at any point during their term. These upgrades are not captured in the market share reporting of most providers but will become an increasingly significant factor over the next few years as adoption of these approaches by legacy installed base customers grows. Illustrating the net impact of these dynamics, all of the top 5 providers of premise-based enterprise voice and UC solutions in North America tracked in the report, except for Microsoft (News  - Alert), experienced annual declines in calendar Q2. The chart below summarizes total market performance and competitive share of the leading providers compared to the second quarter of 2013.

- Alert), experienced annual declines in calendar Q2. The chart below summarizes total market performance and competitive share of the leading providers compared to the second quarter of 2013.

North American Business Communications Manufacturer Product Revenues (2Q’13 vs. 2Q’14)

Source: IntelliCom Market Performance Dashboard, September 2014

Specific competitive highlights from the report include:

Cisco (News  - Alert) continued in the market leadership position in the second quarter of 2014 and experienced an overall revenue decline only slightly worse than the market as a whole. Total manufacturer product revenues fell by 9 percent compared to the same period in 2013. Call Control software revenues were down 6 percent compared to the second quarter of 2013, while desktop user device revenues fell by 18 percent. Although not as large a factor as in the prior quarter, increased uptake on multi-year enterprise software agreements continue to dilute a portion of current-quarter revenues by shifting them into future periods. Software license bundling was a larger factor, with CUWL-based packaging options boosting the Messaging and UC client categories 31 percent and 14 percent, respectively. Contact Center software revenues were down by 23 percent, however, continuing a light first half following an exceptionally strong close to 2013.

- Alert) continued in the market leadership position in the second quarter of 2014 and experienced an overall revenue decline only slightly worse than the market as a whole. Total manufacturer product revenues fell by 9 percent compared to the same period in 2013. Call Control software revenues were down 6 percent compared to the second quarter of 2013, while desktop user device revenues fell by 18 percent. Although not as large a factor as in the prior quarter, increased uptake on multi-year enterprise software agreements continue to dilute a portion of current-quarter revenues by shifting them into future periods. Software license bundling was a larger factor, with CUWL-based packaging options boosting the Messaging and UC client categories 31 percent and 14 percent, respectively. Contact Center software revenues were down by 23 percent, however, continuing a light first half following an exceptionally strong close to 2013.

Avaya retained second place in North America during the second quarter of 2014 but lost significant competitive ground during the period. Total manufacturer product revenues across all premise-based voice platforms, end user devices, and traditional and UC software applications fell by nearly 24 percent compared to a year ago, a much steeper decline than the market as a whole. The company cited delayed purchases by U.S. government agencies as a key factor which would presumably push some shipments into calendar Q3 and Q4. Enterprise customers continue to gravitate toward virtualization in implementing Avaya Aura components which has put downward pressure on solution hardware elements now increasingly shifting to third parties. Strong growth in converged conferencing solutions, particularly Avaya Aura Conferencing 7, offset a double-digit decline in UC client shipments.

Mitel was number 3 in Q2 of 2014 and performed generally consistent with the overall market in North America. Total manufacturer product revenues net of the Aastra acquisition fell by 8.5 percent compared to the same period a year ago. A number of Aastra shipments to larger line sizes offset steeper declines in the core Mitel portfolio which was down more than 13 percent for the period. In terms of portfolio overlap, the Mitel and Aastra products lines and installed base positions are fairly complementary in North America, with Aastra’s very-large enterprise customers in the higher education and other niche verticals not traditionally served by Mitel’s more mainstream focus. Nearly two-thirds of the net contribution of Aastra to Mitel’s product revenues in North America, however, was attributable to its desktop phone business that serves mostly customers of third-party voice platforms and hosted services.

Microsoft held fourth place in the second quarter of 2014 and was the only of the major providers to produce a significant gain relative to Q2 of 2013. Total manufacturer product revenues for premise-based implementations were up more than 22 percent compared to same period a year ago. These results are based on IntelliCom’s estimate of Lync Server seats activated for enterprise voice functionality, associated Exchange UM deployments, and Lync UC client seats activated for enterprise voice integration (either behind Lync or integrated with a third-party PBX (News - Alert)) during the period. Microsoft’s gains were particularly concentrated in the large-enterprise space that it has most aggressively targeted to date and accounted for more than 21 percent of Call Control seat shipments to the 1,000+ segment for the period. Although a number of third-party hardware partners have recently launched packaging of Lync aimed at smaller customers, Microsoft is not yet a significant factor in the SMB range of the voice market.

NEC fell to the number 5 position in the second quarter. However, its total manufacturer product revenues actually outperformed the overall market with an essentially flat performance. Microsoft’s continued growth and seasonality driven by NEC’s fiscal calendar were largely responsible for the drop in relative positioning compared to last quarter. Despite more recently introducing software-centric solutions like the UNIVERGE 3C, a large portion of NEC’s business remains focused on more traditionally packaged KTS/IP hybrid systems. NEC now also offers a UCaaS solution in the U.S. market based on the UNIVERGE 3C that has the potential to broaden its appeal to new customers not receptive to legacy packaging.With two consecutive quarters characterized by moderate declines so far this year, 2014 is shaping up to be an inflection point of sorts where traditionally-packaged business communication solutions begin to gradually cede ground to next-generation delivery approaches in North America.

.jpg) Frank Stinson is a Partner and Senior Analyst with IntelliCom Analytics (News -Alert) and leads the firm's IntelliCom Market Dashboard (IMD) and IntelliCom Market Performance Dashboard (IMPD) research programs. In this role, Stinson provides clients with ongoing strategic assessments of the positioning, direction, and market performance of leading Business Communications providers in the context of key trends transforming the industry.

Frank Stinson is a Partner and Senior Analyst with IntelliCom Analytics (News -Alert) and leads the firm's IntelliCom Market Dashboard (IMD) and IntelliCom Market Performance Dashboard (IMPD) research programs. In this role, Stinson provides clients with ongoing strategic assessments of the positioning, direction, and market performance of leading Business Communications providers in the context of key trends transforming the industry.

Edited by Maurice Nagle

|

Article comments powered by

|

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE